AWASH with opportunity | UN 2023 Water Conference

At the end of March a historic moment took place in New York, the first global water conference in over five decades – the UN 2023 Water Conference. Representatives from government, academia, industry and non-profits joined together in recognition that the progress towards water related goals and targets lies far off track and action must be taken.

At the heart of discussions lay the need for scaling up investment within the WASH sector with increased funding having the potential to unlock huge economic gains and change lives. An issue which WASTE had the privilege of speaking into with the hosting of an exciting side event; AWASH with opportunity. The event brought together WASTE’s partners for a series of lively discussions on how WASH offers a sustainable financing opportunity to a wide range of investors.

Join WASTE’s Senior Experts John Mathai and Valentin Post, who helped to facilitate the event along with fellow Senior Expert Jacqueline Barendse, as they reflect on the conference and outline the key findings.

How do we scale commercial financing for sanitation and water?

One may wonder why this topic is of such interest, as there were several sessions exploring this. Firstly, we are not on track to meet the WASH sustainable development goals (SDGs) and 2030 is rapidly approaching. There are currently 2 billion people without access to safe drinking water, 3.6 billion who lack access to safely managed sanitation services and 80% of faecal sludge/ wastewater ends up in the environment untreated.

Secondly, to meet the WASH SDGs, $114billion a year is required but currently just 20% of this target is being met. There is a huge gap which commercial financing has the potential to fill.

Can a business case be made to attract commercial financing to the WASH sector?

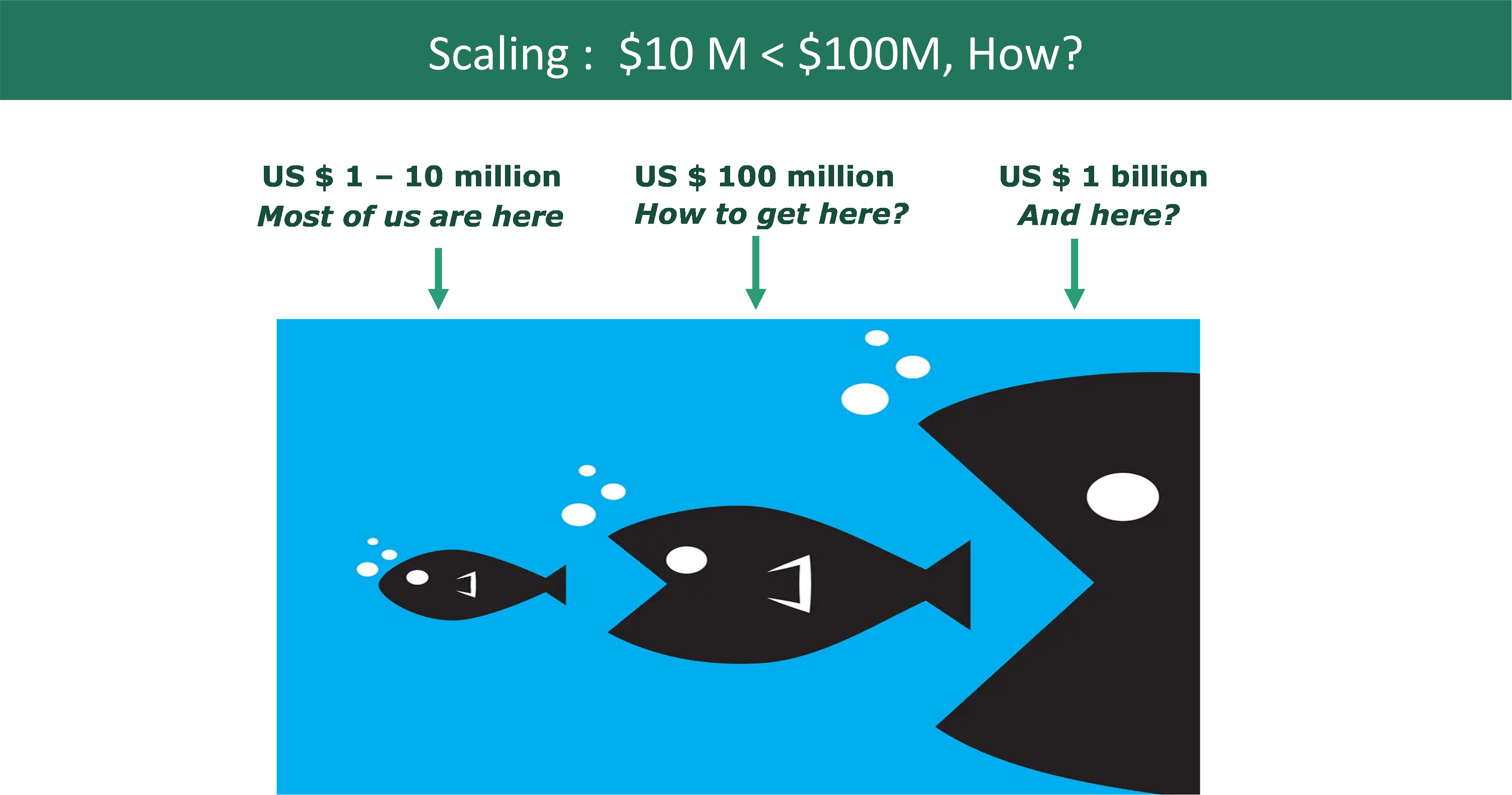

Official development assistance and local financing (tariffs, transfers and taxes) are important components in attracting commercial financing to the WASH sector. At the company level it is very difficult for WASH companies to avail themselves of loans in the $5,000 – $500,000 bracket. The larger the loan size, the easier it becomes. With support instruments (grants, guarantees etc), some organisations have been able to build up portfolios typically ranging between $1 – $10 million.

Commercial impact financing typically requires a fund size of about $100million to make commercial sense. The lower the fund size, the more tailored financing solutions are required. The larger the fund, the less support instruments will be needed as the financial partner will have built up expertise and investors would be able to see examples of good investment.

This financing issue is linked to the scale of operations, with many organisations who have attracted some commercial funding being unable to scale as depicted in the figure below.

Within the session, WASTE and its partners each had an opportunity to share the challenges and progress they are making in relation to this issue:

- Sida is working catalytically to bring more commercial funding into the WASH sector. It uses guarantees as a main instrument to attract more commercial financing in the WASH sector but also supports initiatives such as Take-a-Stake which targets the “missing middle” of enterprise financing (Between $100,00- 500,000).

- FINISH Mondial is keeping running costs low by enabling hardware to be financed through commercial micro-finance, and is focusing on innovations that reduce the hardware costs and attract the lowest part of the missing middle ($5,000-10,000).

- WASTE is finding small guarantees targeting private financing (typically ranging between $10,000 – 100,000) which are sometimes crowded out by public financing. This is achieved through engaging with multi-stakeholders on awareness, demand creation, capacity building and identifying investment needs and opportunities.

- ACTIAM is using their learnings from working with microfinance in 2005, when they saw their initial fund grow 10x more than their expectations to €400million. Financing WASH through microfinance may experience similar growth.

Building connections

Jana Lessenich, CEO of Yunus Social Business (YSB) also shared an important message on the importance of working in collaboration.

Because of the complex nature of issues in the WASH sector, an ecosystem approach is crucial to creating effective and lasting impact. YSB works alongside ecosystem partners that bring in, not only a diverse set of resources and expertise, but also collaborate on delivering impact by making the powerful connection between corporations and social businesses. For example, YSB works as one of the coalition partners of Take-a-Stake alongside WASTE, IKEA Social Entrepreneurship and SIDA. An initiative which seeks to promote investments into the WASH sector. Together with Reckitt, YSB has also launched the Fight for Access accelerator which works to scale grassroots WASH innovations in Brazil and South Africa, equipping local social entrepreneurs with the knowledge and grant funding they need to scale. Finally, through the Unusual Partners program, YSB enables corporations to purchase from social businesses, leveraging corporate buying power as a force for good.

“The connection between social businesses and corporations is essential. By working together, corporations have a means to increase their impact in a way that is closely aligned with their strategies, and social businesses are supported on their path to scaling.” says Lessenich

Although we shared many experiences and challenges, we did not find the silver bullet for growth. However, the feedback and discussions were an important step forward in inspiring ideas on how we can build solutions to ensure sustainable growth.

All participants recognised the importance and urgency of bringing together various stakeholders and organisations to solve the enormous challenges in the WASH sector. Going forward WASTE, through its programmes FINISH Mondial and Take-a-Stake, is striving to bring together knowledge from various organisations including investors, impact measurement agencies, foundations and entrepreneurs to achieve long-term impact within the WASH sector.